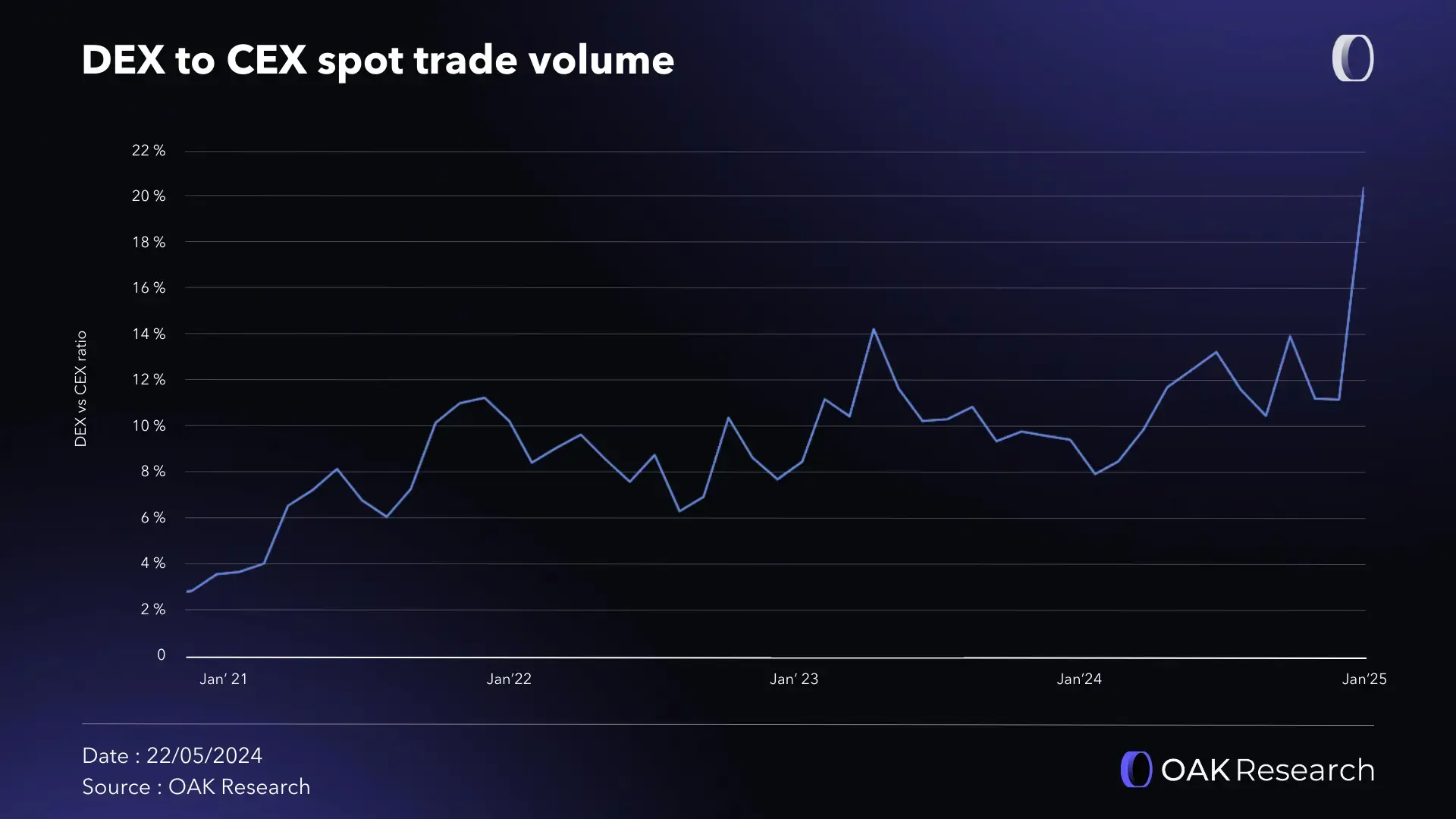

For years, centralized exchanges (CEXs) ruled crypto with an iron grip. Binance, Coinbase, Kraken, KuCoin—these were the gateways to liquidity, speculation, and price discovery. But something is shifting. Slowly at first, then violently. And now the data is impossible to ignore: decentralized exchanges (DEXs) are not only back in the spotlight—they’re gaining ground at a pace that even industry veterans didn’t predict.

The question everyone is now asking is simple but seismic:

Are CEXs finally losing power?

Across the market, DEX volume is climbing. Users are returning to on-chain trading. Liquidity is spreading across blockchains and L2s. And the biggest surprise? Even professional traders are beginning to adopt DEX-first strategies.

A deeper shift is underway—one that could reshape the future of crypto markets entirely.

Let’s unpack why DEX volume is surging again, why traders are migrating back on-chain, and what this means for the old CEX-dominated landscape.

The Catalyst: Trust in CEXs Has Been Eroding for Years

The crypto industry has a long memory. And CEXs have given traders plenty of reasons to lose trust:

FTX collapsed and took billions in customer funds with it.

Celsius, BlockFi, Voyager—all imploded in spectacular fashion.

Withdrawals froze across multiple platforms during panic sell-offs.

Users realized that “not your keys, not your coins” wasn’t just a slogan—it was survival advice.

Every failure pushed more users toward DEX ecosystems not out of desire, but necessity.

Security isn’t just a feature—it’s a reason to move on-chain.

But trust erosion alone doesn’t explain the current surge. Something bigger is happening.

The Rise of Hyper-Active On-Chain Communities

DeFi is no longer a niche for advanced users. Entire ecosystems—Base, Solana, Arbitrum, Blast—have gone mainstream with meme coins, liquid restaking tokens (LRTs), yield strategies, and new-generation liquidity layers.

These communities trade on-chain by default, and they create volume at scale.

Just look at the trends:

• Memecoins now generate billions of dollars in weekly DEX volume

• New L2s launch with DEXs as their primary liquidity hubs

• Token launches increasingly happen on-chain, not on CEXs

• Airdrop seasons drive massive short-term trading activity

When on-chain culture becomes the heart of crypto, on-chain trading becomes inevitable.

CEX Listing Delays Are Creating a New On-Chain First Market

There was a time when CEXs led price discovery.

Not anymore.

Tokens now pump on DEXs before CEXs list them.

This flip is critical:

It means DEXs are now the primary venue where early liquidity forms, where market narratives start, and where traders position themselves for CEX listing catalysts.

This reverses the old power dynamic.

CEXs are reacting to markets that form on DEXs—not the other way around.

When markets shift upstream, users follow.

L2 Evolution Has Made DEX Trading Faster, Cheaper, and Smarter

A key reason DEXs struggled in the past was user experience.

Fees were high.

Transactions were slow.

Front-running was rampant.

Liquidity was fragmented.

That’s changing rapidly across modern Layer-2 networks.

Optimism and Arbitrum made DEX trading cheaper.

Base attracted enormous liquidity and retail traders.

Blast introduced native yield for liquidity providers.

zkSync and Scroll brought near-instant confirmations.

Solana showed that sub-cent fees and millisecond execution are possible.

In short, the DEX landscape is no longer clunky—it’s competitive.

When execution quality approaches CEX standards, users have no reason to stay off-chain.

On-Chain Liquidity Design Has Improved Dramatically

Old-school AMMs were simple but inefficient.

Today’s DEX designs are next-level:

Uniswap v4 is coming with hooks and composable liquidity.

Curve’s stable pools dominate low-slippage swaps.

PancakeSwap brings yield + gamification to BNB Chain.

Intent-based trading is emerging as the next UX breakthrough.

And across the board:

Lower slippage

Deeper liquidity

Better routing engines

MEV protection

Cross-chain aggregation

Smarter LP incentives

This is not DeFi 2020 anymore.

DEXs look increasingly like professional trading environments.

Regulatory Pressure Is Squeezing CEXs Worldwide

In nearly every jurisdiction, regulators are targeting centralized exchanges:

The U.S. SEC’s pressure on Coinbase and Binance

Europe’s MiCA rules tightening compliance

Asian regulators cracking down on unlicensed custody

Even friendly nations requiring strict KYC/AML

This creates an odd paradox:

As CEXs become more regulated, the friction for users increases.

More verification.

More limits.

More surveillance.

More delays.

More uncertainty.

DEXs, meanwhile, operate permissionlessly—no accounts, no documents, no custody.

The more regulators push CEXs, the more users quietly migrate on-chain.

Institutions Are Finally Moving On-Chain Too

This might be the most surprising trend:

Institutional players are starting to experiment with on-chain liquidity.

BlackRock is exploring tokenized assets.

JP Morgan has run multiple private blockchain transactions.

Major funds now trade LRTs and RWAs through smart contract systems.

Market makers such as Wintermute and Jump regularly interact with DEX pools.

As institutions bring deeper liquidity, DEXs become more efficient and appealing.

Ironically, institutions may accelerate the rise of DeFi itself.

DEX Volume Surges During Volatility—And That’s the Tell

Monitoring activity shows a clear pattern:

When volatility spikes, DEX volume explodes.

Why?

Because traders need:

Instant execution

No withdrawal delays

No risk of frozen accounts

Faster access to newly launched tokens

During events like:

New meme seasons

Airdrop farming waves

BTC breakouts

L2 ecosystem rallies

High-volume liquidation cascades

DEXs outperform CEXs in both speed and flexibility.

Volatility is where market power shows itself—and DEXs are winning that battlefield more often.

CEXs Aren’t Dying—But They’re Losing Dominance

It’s important to note:

CEXs remain crucial for onboarding, liquidity depth, fiat access, and futures trading.

They aren’t disappearing.

But they are losing something historically unshakable:

Absolute control.

Power is shifting, not collapsing.

The new structure looks like this:

CEXs → for onboarding, fiat ramps, leverage, institutions

DEXs → for trading, discovery, yield, early markets, innovation

This hybrid model defines the future.

The Future of Trading Will Be Chain-Agnostic

The direction is clear.

DEXs will evolve into:

Faster

Cheaper

More liquid

More professional

More composable

More protected against MEV

CEXs will integrate more on-chain options to stay competitive.

And traders?

They won’t think in terms of “CEX vs. DEX” at all.

They’ll simply trade where liquidity is—on-chain, cross-chain, multi-chain.

The new market meta is interoperability, not centralization.

Final Takeaway

DEX volume is rising for a reason—multiple reasons.

CEX trust erosion, better on-chain tools, explosive L2 ecosystems, regulatory pressure, institutional liquidity, and the new on-chain culture are all combining into a powerful tailwind.

CEXs aren’t being replaced.

But their dominance is fading.

The center of gravity in crypto is moving on-chain—fast.

The question for traders now is simple:

Will you still wait for CEXs to catch up?

Or will you follow the flow of liquidity to DEXs, where the next wave of opportunity is already forming?