For years, DeFi lending survived on one core principle: over-collateralization. If you wanted to borrow $10,000, you had to lock $20,000 or more. It was safe, predictable — and extremely inefficient. But as the DeFi market matures and liquidity becomes more competitive, the sector is undergoing a much-needed transformation. Capital efficiency is no longer an optional improvement. It has become the new king.

Today’s lending protocols aren’t just fighting to offer better yields or safer collateral; they’re competing on how much utility they can extract from every dollar locked in the system. And the winners of this race are shaping the next era of decentralized finance.

Capital-efficient lending is the most important shift happening in DeFi right now, and it’s rewriting everything from borrowing mechanics to how users deploy liquidity across chains.

Let’s break down what’s changing—and why this evolution matters more than most people realize.

Why Capital Efficiency Matters Now More Than Ever

In traditional DeFi, users deposit collateral that sits idle while securing loans. That idle capital is locked, static, and underutilized. The more collateral you lock, the lower your capital efficiency.

But here’s the problem: the crypto industry has reached a point where liquidity must be optimized, not wasted. Tokenization, BTC integration, restaking, and multi-chain liquidity have created ecosystems where capital constantly moves. Capital that remains idle creates friction, reduces yield, and slows down expansion.

In a competitive global environment where yields are compressing and user expectations are rising, capital efficiency becomes the deciding factor for which protocols dominate the next cycle.

The winners will be the platforms that deliver more borrowing power, more yield, and more flexibility — without requiring absurd over-collateralization.

The Old Model Is Dying: Over-Collateralization Can’t Scale

The original DeFi lending model is simple:

Deposit more than you borrow, or you risk liquidation.

It works. It’s safe. But it’s fundamentally capped.

Major limitations include:

- You need large capital upfront

- Borrowing power is limited

- Utilization rates are low

- System-wide liquidity becomes fragmented

- Liquidations add systemic shock

This model was fine for 2020. It’s outdated for 2025.

DeFi has evolved, and lending protocols must evolve with it.

The New Wave: Lending Protocols Built for Maximum Efficiency

The next evolution of lending protocols is all about optimizing how collateral is used. Several innovations are driving this shift — each making the system more scalable and flexible.

Here are the most important ones.

1. Liquid Staking and Liquid Restaking as Collateral

LSTs (Liquid Staking Tokens) and LRTs (Liquid Restaking Tokens) are the biggest catalysts for capital efficiency. Instead of locking idle collateral, users deposit yield-bearing assets.

This means:

- Your collateral earns yield

- That yield can offset borrowing interest

- The same collateral can be used across multiple protocols

A single ETH doesn’t just secure a loan—it generates yield, secures networks, and powers restaking economies. This is the foundation of multi-layered capital productivity.

2. Zero-Liquidation Borrowing Models

Zero-liquidation loans remove the most capital-inefficient mechanism in DeFi: forced liquidations.

By eliminating liquidation risk through hedging, yield-backed repayment, or locked collateral strategies, users can:

- borrow without fear

- avoid fees

- deploy capital more aggressively

- contribute to deeper liquidity pools

Removing liquidation triggers boosts long-term borrowing and encourages more productive use of collateral.

3. Multi-Collateral Lending and Dynamic Risk Engines

Instead of rigid borrowing parameters, new lending protocols use real-time on-chain data, volatility modeling, and dynamic risk scoring.

This enables:

- flexible loan-to-value ratios

- variable collateral requirements

- support for more asset types

- smoother risk-adjusted lending

This creates a capital environment that works more like modern finance than a static smart contract.

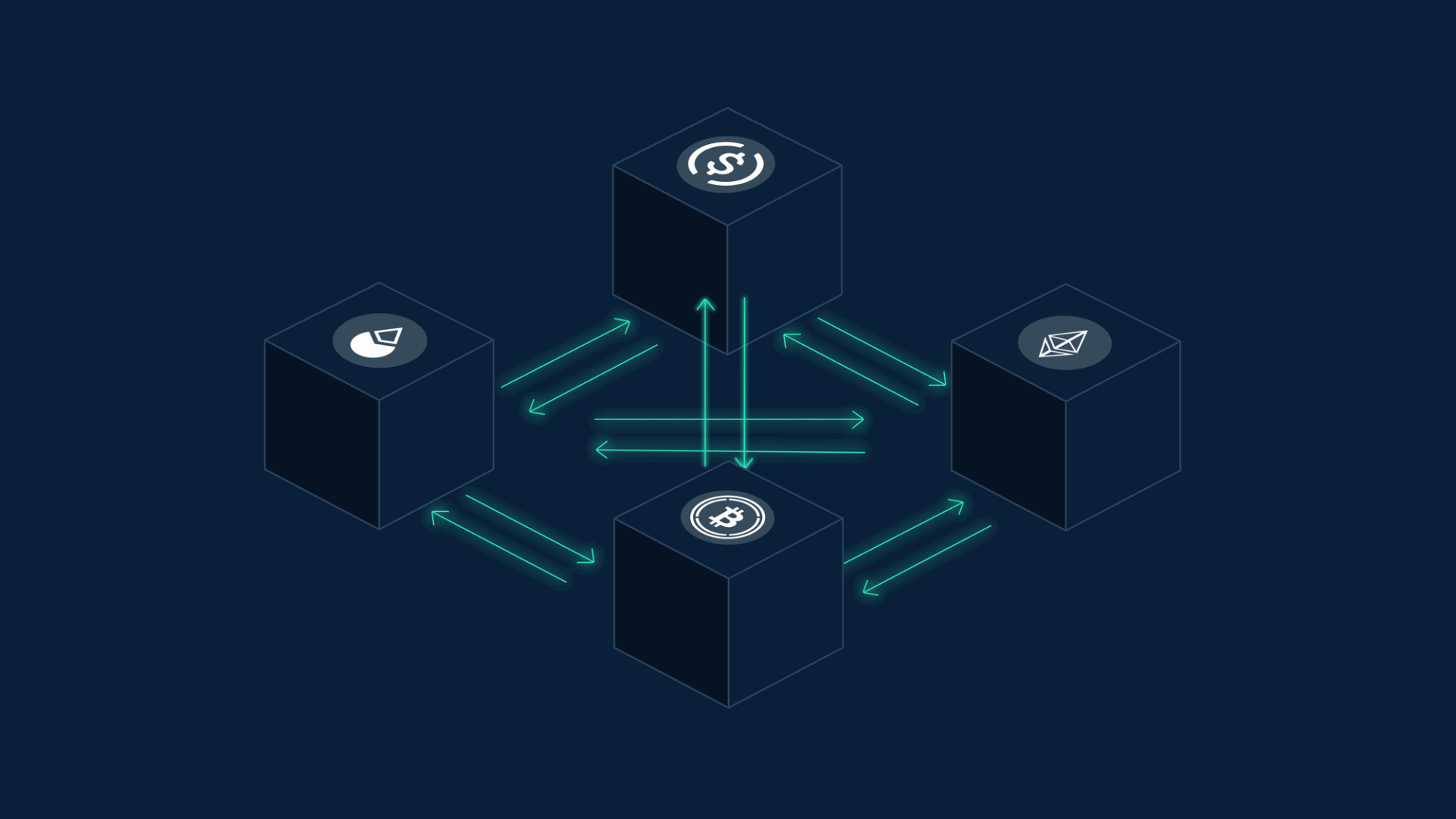

4. Cross-Chain Liquidity Networks

Liquidity no longer lives on a single chain.

Protocols now operate across:

- Ethereum

- Bitcoin L2s

- Modular rollups

- App-specific chains

- High-throughput L2s

Cross-chain lending and unified liquidity layers allow capital to flow freely where it’s most valuable. Users no longer need to bridge manually or sit idle waiting for opportunities.

Capital efficiency rises as liquidity becomes composable across ecosystems.

5. Options-Based Lending and Hedged Borrowing

Financial derivatives are entering DeFi lending in a structured and automated way.

Borrowers can hedge downside risk through on-chain options, futures, and delta-neutral strategies. This makes collateral safer without requiring extreme collateralization.

Protocols that integrate hedging tools create borrowing systems that mirror institutional-grade financial engineering.

This type of architecture increases:

- capital access

- borrowing confidence

- risk-adjusted yields

- overall lending stability

Why Capital Efficiency Is Becoming the Core Metric

The new generation of DeFi users evaluates lending platforms based on one question:

“How much can my capital do for me?”

Capital-efficient protocols answer this by enabling:

- higher borrowing power

- multiple yield streams

- cross-protocol utility

- stable liquidity

- reduced exposure to liquidation

- better returns for lenders

- better safety for borrowers

The more capital-efficient a protocol is, the more attractive it becomes in a crowded market.

This is why new lending protocols are focusing less on token incentives and more on designing systems that maximize economic productivity.

Bitcoin’s Entry Will Accelerate Capital Efficiency

Bitcoin entering DeFi is one of the biggest macro shifts this industry has seen.

When BTC becomes:

- stakable

- restakable

- collateralizable

- yield-generating

- bridgeable

it unlocks a massive pool of high-value capital.

BTC is the largest untapped asset in crypto. The moment lending protocols integrate Bitcoin L2s, yield models, and on-chain hedging, capital efficiency across the entire industry will multiply.

A highly liquid asset like Bitcoin entering capital-efficient lending markets will amplify growth in ways previous cycles never achieved.

The Path Ahead: What the Future of Lending Looks Like

If capital efficiency is the new king, the next generation of lending protocols will focus on:

- multi-yield collateral

- advanced risk engines

- cross-chain fluidity

- hybrid on/off-chain credit scoring

- hedging-backed borrowing

- liquidation-free debt positions

- tokenized real-world collateral

- Bitcoin-enabled liquidity markets

- institutional-grade lending vaults

This evolution pushes DeFi closer to becoming a real global financial layer — not just a cycle-driven trend.

Final Verdict: Capital Efficiency Will Define the Winners of the Next DeFi Cycle

We are moving from a world where DeFi lending was simple but restrictive to one where it becomes dynamic, multi-layered, and economically intelligent. Capital efficiency is the force driving this transition.

The protocols that embrace this new reality will shape the future — and attract the deepest liquidity. The ones that cling to old models will be left behind as yield innovation and smart collateralization leap ahead.

This is the most important phase DeFi lending has ever entered.

Not because of hype — but because for the first time, lending protocols are being built to maximize value, not just lock it away.